Solution: Ideally you would change to Handle Taxes Separately and select the appropriate vendor for each tax item there.

Of course you will also see this if you are using Handle Taxes Separately and did not select a vendor in the Taxes Mapping. Possible additional issue - We're not sure if previous versions would even have allowed it, but if you are mapping the tax categories through Transaction Categories Mapping (not handling taxes separately) and selected an Other Current Liability account in the mapping for a tax, then this will not work. You will have to do this for each mapping corrected.Ĥ. You can ignore this warning (click "Yes" to continue, then OK on the reminder). Note: Assuming you're using version 10.0 (rev.s) of Campground Master or earlier, you may get a warning when adding the mapping that "Taxable?" or "Is this an auto-tax rate?" must be checked (since previous versions of QB required them). uncheck the "Taxable?" box) and click Add Mapping again. It will be removed from the bottom list, but it will also be selected automatically in the category/item/account lists above. Remove the "Is this an auto-tax rate?" flag on all tax categories mapped in Taxes Mapping (if using "Handle taxes separately").Īs a reminder - To change a mapping, you need to select it in the bottom "Mappings defined" list and click Delete. Remove the "Taxable?" flag on all categories mapped in Transaction Categories mapping.Ģ. Solution: This is caused by 2 flags that usually had to be set in previous versions, but now must not be set. (but also see issue #5 which can create the same error) QuickBooks error message: Transaction amount must be positive. QuickBooks will try to automatically calculate taxes on the sales receipt after importing, even though the export already includes the taxes, which causes an incorrect non-zero balance on the entry and will also often result in an error. One solution would be to create a fake item in QB and select that fake item as "most common tax item" in that QB setting so it's different than any used in the export mapping.ģ. In QB, see Preferences Sales Tax Company Preferences, "Your most common sales tax item" drop-down. Edit your Taxes Mapping to include the item for each category.Īdditional note: This can also be caused by having one of the Tax Items you're mapping to as the "most common sales tax item" in QB (apparently it can add that to sales receipts by default, causing a duplication). Make sure the "Sales Tax Item" type is selected for the items. Solution: Make sure an appropriate Item is created in QB for each sales tax category (each category seems to need a different Item, even if going to the same Account). You cannot use the same tax item in both the line items and the txn tax There is an invalid reference to QuickBooks Item "taxitem" in the SalesReceipt line. If you selected the same Item for more than one category in Taxes Mapping, you will get an error like: There is an invalid reference to QuickBooks ItemSalesTax "" in the SalesReceipt. If you didn't select an Item in the Taxes Mapping, you will get this error: In addition, these Items should all be different. Sales taxes must have a QB "Item", if importing tax categories separately (using "Handle taxes separately" in Export to QuickBooks setup). Solution: Create a special account for this in QB, of type Other Current Asset, and select that account instead (the "Account to use for Accounts Receivable" in the Export to QuickBooks setup).Ģ. Transaction split lines to accounts receivable must include a customer on that split line in QuickBooks The QB account used for the A/R balance cannot be an actual "Accounts Receivable" QB account type - the type must be Other Current Asset. You will need to determine for yourself if this will cause any further issues.ġ. However, we do not know how the changes might affect your overall accounting and reporting procedures, or how they will affect QuickBooks operations. The QuickBooks error message that will show in the "Results" file is also shown for reference.ĭisclaimer: The solutions provided below should allow the Import function to work without errors.

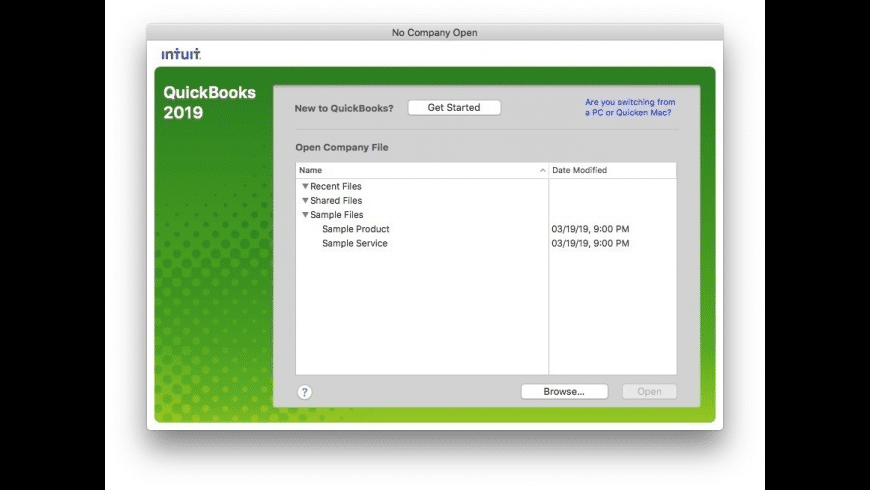

QUICKBOOKS MAC 2019 MAR INVOICE AS UNPAID HOW TO

Fixing this will not require changing your Campground Master version, however you may have to change the Export to QuickBooks mapping and possibly make some changes in your QuickBooks setup as well.Ī summary of the issues found and how to resolve them is below. We have found solutions to all of the known issues.

There were several changes made in the QuickBooks 2019 version which caused the importing to not work for most Campground Master users. Exporting to QuickBooks 2019 and beyond Exporting to QuickBooks 2019 and beyond

0 kommentar(er)

0 kommentar(er)